Who we are

Sage Homes is England’s largest provider of newly built affordable housing. As a registered provider, we are proud to be helping to address the housing crisis by providing affordable housing to those most in need. We provide Shared Ownership homes (part buy, part rent) and rental homes to those on local authority waiting lists to customers across England.

Our customers are at the heart of our business which is why we are committed to providing high quality homes and an excellent service. We strive to have a positive impact on everyone we work with, from our customers to our partners to each other.

Providing homes, inspiring change, improving lives

Our purpose is to provide homes to those in need, inspire change, innovate within our sector and improve lives enabling our customers to thrive. We deliver high-quality, well-managed and customer-focused affordable housing. We are bringing meaningful, stable capital to the sector, enabling increased development of high-quality affordable housing for the people who need it most.

Top quality customer service is of the upmost importance. It defines what we do, from how we are funded, to how we do business with our partners. With our customers at the forefront we are adopting a fresh digital approach. All our rental and shared ownership customers have access to our digital portal to make payments, log service requests or message customer services.

FAQs

Shared ownership

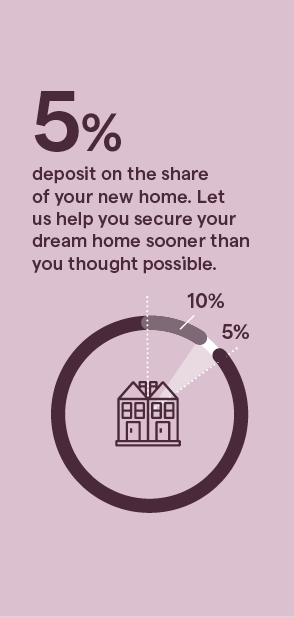

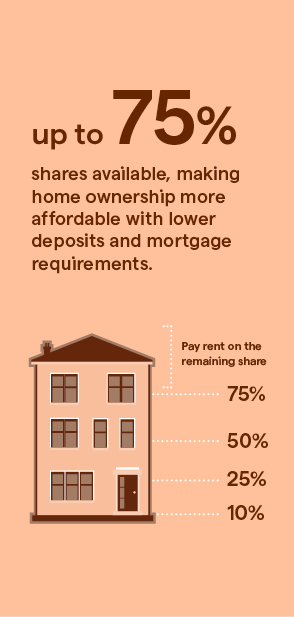

The Shared Ownership scheme is a ‘part buy, part rent’ way of owning your own home for a smaller upfront payment – making it easier for first time buyers to get on the property ladder. ‘Part Buy, Part Rent’ is a way of owning your home. This simply means you buy a share (or ‘part’) of the home e.g. you own 40%, which will require funding, normally by a mortgage. On the remaining 60% share, you will then pay a subsidised rent – this means you are purchasing a leasehold house or flat.

This will depend on your financial circumstances. Note that you are expected to buy the largest share of the property you can reasonably afford. The initial share values available are usually a minimum of 10% and a maximum 75%.

Not sure what you can afford to buy with Shared Ownership? Our shared ownership calculator will help you to look at monthly costs for buying and owning a home with Shared Ownership.

Living In Your Shared Ownership Home

Yes, you can increase your share in a Shared Ownership home through a process known as ‘staircasing’, allowing you to own more of the property as and when you can afford to do so. However, there may be some restrictions on this so please check with our team for specific developments or homes.

While you’re welcome to buy with another person, Shared Ownership does not mean you have to share the ownership of the property.