Sapphire Fields

Register your interest

Click to filter

|

2 Bedrooms Semi-detached house |

2 Bedrooms Semi-detached house |

3 Bedrooms Semi-detached house |

|---|---|---|---|

| Property Number | 92 | 91 | 90 |

| Availability | FOR SALE | FOR SALE | FOR SALE |

| Advertised Share | 50% | 50% | 50% |

| Full Market Price | £365,000 | £365,000 | £415,000 |

| Deposit From | £9,125 | £9,125 | £10,375 |

| Monthly Rent | £419 | £419 | £476 |

| Monthly Mortgage Cost | £903 | £903 | £1,027 |

| Monthly Service Charge | £64 | £64 | £68 |

| Estimated Monthly Cost | £1,386 | £1,386 | £1,571 |

| Bedrooms | 2 | 2 | 3 |

| Bathrooms | 1 | 1 | 1 |

| Number Of Floors | 1 | 1 | 1 |

| Tenure | Leasehold | Leasehold | Leasehold |

|

|

|

|

Sapphire Fields

Overview

Soak up the summer warmth — and stay cosy all winter too.

Most of our brand-new Shared Ownership homes come with an EPC A rating, meaning your home stays warmer for less — even when temperatures drop.

Buy a home this summer, and we’ll help keep you warm this winter with a £1,000 towards your winter energy bills*

*£1,000 allowance on select homes, provided upon completion.

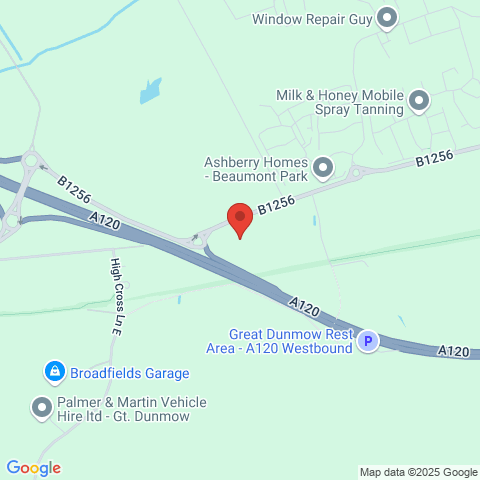

Sage Homes is proud to offer this collection of homes at Sapphire Fields, a development of brand-new homes in Great Dunmow, an idyllic market town in north Essex. Surrounded by open countryside but just 20 minutes on foot from the quaint High Street, a variety of shops and great restaurants.

Sapphire Fields will appeal to families, attracted by the rural location and good schools, as well as to professionals working in Bishop’s Stortford, at Stansted Airport, or in the capital.

Each home offers modern living with a stylish kitchen/diner which includes oven, hob and extractor fan. A contemporary living room, ground floor cloakroom and modern bathroom. This home has been finished to a high standard throughout.

When looking to step onto the property ladder, this is the perfect opportunity to do so.

Travel Times

- 35 mins From Stansted Airport to Cambridge

- 48 mins From Stansted Airport to London

- 4 mins Local Sixth Form College

- 12 mins Skate Park

- 6 mins Local supermarket

- 10 mins Stansted Airport

- 23 mins Bishop's Stortford

Key Features

- Three piece bathroom with shower over bath

- Allocated parking

- Ample storage space

- Close to local amenities

- Flooring throughout

- Double glazing

- Semi-detached homes

FAQs

Shared ownership is a government-backed scheme, designed to make stepping onto the property ladder more affordable. You buy a portion of a home normally with a mortgage and a deposit, and pay a low-cost rent on the rest.

The eligibility criteria for Shared Ownership is simple; as long as you don't currently own, or won't own another property when you move in to a new home, you're likely to qualify.

Your annual household income (that's both yours and your partners' if buying together) can't exceed £80,000 (or £90,000 in London) and you'll need to have savings to cover purchasing costs such as solicitors fees and your mortgage deposit.

There's no fixed minimum income; you just need to be able to afford to buy the home and the monthly costs - this will be established via an affordability.

No - the scheme is designed to help people buy a suitably sized home that they cannot afford to buy otherwise. That typically means first time buyers, but if you've owned a home before and are selling, perhaps due to a divorce or needing to buy a bigger home, and cannot afford to buy, you might be eligible for Shared Ownership.

Affordability Calculator

Disclaimer

The figures and estimates shown in this calculator should not be relied on as confirmation of affordability and should only be used as an indicative guide to monthly costs. The monthly rental cost is based on 2.75% on the retained equity (subject to change please ask your sales agent). This will usually increase by the annual rate of RPI. The monthly mortgage cost is based on a Variable Rate Mortgage at 5.50% over a 35-year repayment loan. Other costs will apply such as service charge. Sage Homes is not authorised or regulated by the Financial Conduct Authority to provide financial advice. You should always seek advice and recommendations from an independent financial advisor regarding mortgage products, affordability, interest rates, repayment methods and terms and conditions. You should also seek independent legal advice. Your home may be repossessed if you do not keep up payments on a mortgage or any other loan secured against it.